AAIS VALUABLE PAPERS AND RECORDS COVERAGE ANALYSIS

(August 2018)

|

|

INTRODUCTION

The American Association

of Insurance Services (AAIS) Valuable Papers and Records Coverage insures

commercial enterprises' important business papers, such as books, documents,

records, manuscripts, maps, films, prints, deeds, mortgages, copyright and/or

patent rights to key products, and similar and related documents and materials.

Few businesses can operate without acquiring several valuable documents and

operations can be seriously affected if they are lost or damaged.

This coverage form is not used as much as in the past because Valuable Papers and Records Coverage is an additional coverage or an extension of coverage with significant sub-limits in many filed commercial property coverage forms and policies. However, this coverage form usually offers broader coverage.

ELIGIBILITY

Any commercial account is eligible to purchase Valuable Papers and Records coverage.

Although money, securities, bank notes, checks, travelers' checks, stamps, tokens, tickets, and data processing media may be considered valuable papers, they are not covered under this form.

POLICY CONSTRUCTION

AAIS Valuable Papers and Records Coverage requires at least these four forms:

- IM 7900–Inland Marine–Declarations

- CL 0100–Common Policy Conditions

Related Article: CL 0100 AAIS Commercial Lines Common Policy Conditions

- IM 1555–Schedule of Coverages–Valuable Papers and Records

- IM 1550–Valuable Papers and Records Coverage

IM 1555–SCHEDULE OF COVERAGES–VALUABLE PAPERS AND RECORDS

This Schedule of Coverages is used with IM 1550–Valuable Papers and Records Coverage. IM 1555 contains the following information:

Schedule of Locations

A location number and address must be entered for each premises in addition to the limit.

Property away from described premises is covered automatically for $5,000. The $5,000 or a higher limit must be entered in the space provided.

Scheduled Items

Specifically described valuable papers can be scheduled. These items should be removed from the limits above to prevent duplicate coverage. The scheduled item is described and the location number where it is kept is provided from the schedule of locations above.

Note: This is a very important provision. Many eligible documents are dynamic, and their values may change. Others are unique or "one of a kind" and cannot be valued by normal valuation methods and techniques. Any time an insured has unique and unusual papers or records with unusually high or changeable values, they should be singled out and specifically scheduled with their own limits. They should not be combined with other common documents where their values might not receive the attention they deserve, and the total value might not be adequate at the time of loss.

Deductible

The deductible amount the named insured retains for each covered loss must be entered in the space provided.

Description of Storage Containers

Spaces are available to enter the following for each location that has a storage container:

- Location Number

- Type of Storage Container

- The Storage Container Manufacturer’s name

- The Storage Container’s Class or Hour of Label

- The name of the party that issued the label on the Storage Container

Note: There is no coverage for valuable papers and records that are outside of such storage containers when the business location is closed for business. This means that entries in this section must be accurate.

Optional Endorsements

Two optional endorsements are available based on entries on the schedule of coverages.

- IM 1275–Calendar Date or Time Failure Exclusion

This endorsement excludes losses due to any electronic data processing equipment, computer programs, software, media, or data that fails to correctly recognize, interpret, or process any encoded, encrypted, or abbreviated date or time.

- IM 1561–Exclusion for Library Coverage

This endorsement adds other Property Not Covered and Perils Excluded for library risks.

Rates and Premium

Valuable Papers and Records Coverage is written on a non-reporting basis. This section has spaces to enter the annual premium and the rates for blanket property and scheduled items.

IM 1550–VALUABLE PAPERS AND RECORDS COVERAGE ANALYSIS

This analysis is of the 01 05 edition.

Agreement

This section states that the insurance company provides the coverage

described in return for the named insured paying the required premium. This

agreement is subject to all the coverage form’s terms, the schedule of

coverages, and any additional conditions that apply. Endorsements or additional

schedules identified on the schedule of coverages also apply.

A statement that certain words and phrases identified in bold print in

the coverage form are defined in the Definitions section that is immediately

following this Agreement.

Note: There is no clearly marked space on the

schedule of coverages to list endorsements or additional schedules that apply

at inception.

Definitions

Defined words are used throughout the coverage form. When these terms are used in the coverage form, the meaning provided in this section must be applied. Ten terms are defined:

1. You and your

The parties that are

specifically named on the declarations as insureds.

2. We, us, and our

The insurance company that is

providing the coverage.

3. Limit

The amount of coverage that applies.

Note: There is no reference as to what it applies; it just applies.

4. Pollutant

This is a broad and expansive term. It is solids, liquids,

thermal or radioactive contaminants, and irritants. It includes, but is not

limited to, acids, alkalis, chemicals, fumes, smoke, soot, vapor, and waste.

Waste includes materials intended for recycling, reclamation, and

reconditioning, as well as for disposal. Visible and invisible electrical or magnetic

emissions and sound emissions are also considered pollutants.

5. Schedule of

coverages

Any

page labeled as such that contains coverage information, including declarations

or supplemental declarations.

6. Sinkhole collapse

The

earth’s surface suddenly settling or collapsing into an underground opening

that was created by water acting on limestone or some other rock

formation. Sinkhole collapse does not include either the land’s value or the

cost to fill sinkholes.

7. Specified perils

The

named perils of aircraft, civil commotion, explosion, falling objects, fire,

hail, fire extinguishing equipment leakage, lightning, riot, sinkhole collapse,

smoke, sonic boom, vandalism, vehicles, volcanic action, water damage,

the weight of sleet, snow or ice and windstorm. Two terms need

further explanation.

Falling

objects does not include loss to personal property stored in the

open. It also does not include damage to the interior of buildings or personal

property stored in buildings unless a falling object first breaches the

building's exterior.

Water

damage is the sudden or accidental discharge or leakage of water or

steam. However, it must be a direct result of a part of the system or

appliance that holds the water or steam cracking or breaking.

8. Terms

These are all provisions, limitations, exclusions, conditions, and

definitions that apply to this coverage.

9. Valuable papers

These are inscribed, printed or written documents, manuscripts, or

records. The term is also abstracts, books, deeds, drawings, films, maps, and

mortgages.

10. Volcanic action

An

airborne volcanic blast or shock wave. It is also ash, dust, and

particulate matter along with any lava flow. The term does not include the cost

of removing dust, ash, or particulate matter from the covered property

unless there is direct physical damage to the property.

|

|

|

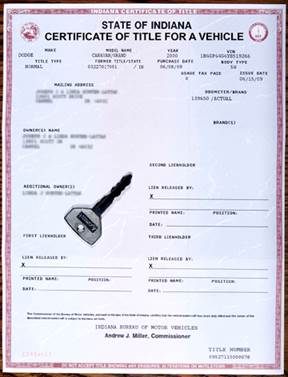

Example of a

valuable paper |

Property Covered

The insurance company covers property that is described below unless it is excluded or subject to limitations.

Valuable Papers

1. Coverage

Direct physical loss to the named insured's owned valuable papers is covered when caused by a covered peril. Such damage to similar or related property of others in its care, custody, or control is also covered.

|

|

2. Coverage Limitation

Only valuable papers and records that are inside a building that is at the premises described on the schedule of coverages is covered.

3. Storage Limitation

After the premises has closed for business, coverage applies only to those valuable papers or records that are in the storage containers listed on the schedule of coverages. The only exception to this limitation is that if the named insured or its employees are using them at the time of loss, coverage will continue to apply.

Property Not Covered

There is no coverage for the following property:

1. Contraband

Property that is illegal to possess is not covered. Property that is legal

to possess but that is being used as part of an illegal trade or that

is being transported illegally is also not covered.

2. Data Processing Media

The data processing media on which data is stored is not covered. Examples of such media are magnetic tapes, disk packs, diskettes, paper tapes, and cards but other storage media is also not covered. This is only referring to the media, the documents, manuscripts, or records stored on such media remains covered.

3. Money and

Securities

Accounts, bills, currency, coins, and food stamps are not covered. Travelers and register checks, lottery tickets that are not being held for sale, money orders, notes, and securities are also not covered. Other evidence of debt is also not covered.

Note: Lottery tickets that are not being held for sale are not excluded. This means lottery tickets held for sale are covered. In addition, a court might have to define the term “other evidence of debt” if a dispute arises.

This property is more correctly insured under commercial crime coverage

forms.

Related Article: Commercial Crime Coverage Analysis

4. Property Held for

Delivery

Property that has been sold but has not yet been delivered is not covered.

5. Property in

Storage

Valuable papers that are stored at a location that is not on the schedule of coverages are not covered.

6. Property That

Cannot Be Replaced

Valuable papers that cannot be replaced with similar materials are not covered. There is an exception to this. Any valuable paper or record that is specifically listed, described, and for which a limit has been entered on the schedule of coverages is covered.

7. Samples for Sale

Any samples that are being held for sale are not covered.

Coverage Extensions

There are two coverage extensions. The

limit for each is the default limit in the coverage form. These limits are not

added to or combined with limits for any other coverage extension, optional

coverage, or coverage added by endorsement. They are not subject to any

coinsurance provisions that apply elsewhere in the coverage form.

1. Emergency Removal

a. Coverage

This

covers direct physical loss to covered property that was removed from the

scheduled location to avoid loss or damage from an impending covered peril. The

loss can occur while in transit between the scheduled location and the

sanctuary location. This coverage is unique in that the property that is being

moved is not subject to any exclusion while in transit or at a sanctuary

location. However, the reason for moving the property must be due to

a covered peril.

b. Time Limitations

The named insured must

notify the insurance company within ten days after it moves the property. Coverage does not extend past the expiration date. However,

there is no other time limitation.

c. Coverage Limitation

This coverage is part of the applicable limit for coverage as Property Covered describes, not in addition to it.

Note: Coverage does not extend past the expiration date. If the named insured has property at an emergency location when coverage renews, the emergency location must be listed as a premises or coverage no longer applies.

|

Example: Arnie's Architects has many documents that qualify as valuable papers and records. His coastal Florida office is threatened by the imminent landfall of a category four hurricane he is sure will level his establishment. Arnie packs up these records, puts them in a truck, and begins to drive inland. Unfortunately, he takes a 25 mph exit at 50 mph, the truck overturns, and the contents are destroyed. Coverage applies on his valuable papers and records for the full limits on the schedule of coverages because of this coverage extension. |

2. Property Away From

Described Premises

a. Coverage

Direct physical loss to valuable papers and records that are away from locations listed on the schedule of coverages is covered when caused by a covered peril.

b. Coverage Exclusion

Valuable papers that are in storage are not covered.

c. Limit

While the coverage limit is $5,000 per loss, it can be increased on the schedule of coverages.

d. This is a Separate

Limit

The limit provided is separate from the limit that applies to other Property Covered.

|

Example: Arnie constantly takes engineering studies and architectural drawings and plans out of the office to meet with his clients at their offices and building sites. When he or one of his associates does so, this coverage extension applies, and those documents are fully insured when away from the designated premises. Arnie recognizes his exposure and schedules a higher limit. |

Perils Covered

Coverage applies to risks of direct physical loss unless the loss is limited, or an excluded peril causes the loss.

Other Coverages–Collapse

1. Coverage

Loss

to covered property when caused by a direct physical loss that involves collapse of a building or structure, or any part of a building or structure containing covered property.2. Covered Perils

The only collapse coverage provided is collapse caused by one or more of the following:

- One of the specified perils or

breakage of building glass, to the extent that this coverage form insures those perils

- Hidden

decay. This does not apply if the named insured was aware of the

decay before the collapse.

- Hidden insect or

vermin damage. This does not apply if the named insured was aware of

the damage before the collapse.

- Weight of people or personal property. There is no statement as

to where the people or personal property must be.

- Weight of rain. This is limited to only that rain

that collects on a roof.

- Using defective

materials or methods of construction, remodeling, or renovation. This

applies only if the collapse occurs during any of these operations.

- If the collapse occurs

after construction, remodeling, or renovation are complete and defective

materials or methods of construction, remodeling or renovation

is partially to blame, coverage applies if any of the

other contributed to the loss.

3. Collapse Means

Collapse is the sudden and unexpected falling in or caving in of a

building or structure (or any part of it) that prevents the building

from being occupied for its intended purpose.

4. Collapse Does Not

Mean

The following buildings and structures are not considered to be

in a state of collapse:

- One that is still

standing or any portion of it that is still standing. This applies

even when there is evidence of bending, bulging, cracking, expanding,

leaning, sagging, settling, or shrinking.

- One in danger of

falling in or caving in

- When a portion is

still standing even though it is separated from another portion of the

building or structure

5. Coverage

Limitation

This coverage does not provide any increase in the limit for the covered property.

Perils Excluded

1. Primary Exclusions

The

first group of exclusions is essentially absolute. Subject to specific

exceptions, loss or damage by each is totally excluded, regardless of any

other cause or event that contributes to a loss, either concurrently or in any

other sequence. The insurance company does not pay for any direct or indirect

loss or damage caused by or that results from any of these events.

a. Civil Authority

There is no

coverage for loss that results from an order any civil or government

authority issues. These orders may include seizure, confiscation,

destruction, or quarantine of property but this exclusion is not limited to

only these. The only exception is when a civil authority destroying property as

a means of controlling a fire causes the loss or damage. This exception applies

only if the fire is the result of a covered peril.

b. Nuclear Hazard

The insurance

company does not insure against loss or damage from any nuclear reaction,

radiation, or contamination, whether the nuclear incident was controlled or

not, or was caused by any means. Any loss caused by the nuclear hazard is

not treated as a loss caused by fire, explosion, or smoke. However, coverage applies to direct loss or

damage caused by fire that results from the nuclear hazard.

c. War and Military Action

The insurance

company does not pay for loss or damage caused by any act of war. Undeclared

and civil war or warlike action by a military force are all

considered war. All actions taken to hinder or defend against an actual or

expected attack by any government or sovereign authority that uses military

personnel or other agents are also considered war and excluded. In

addition, acts of insurrection, rebellion, revolution, or unlawful seizure of

power and any action any government authority takes to prevent or defend

against any such acts are excluded. If any action within the terms of this exclusion involves nuclear

reaction, radiation, or contamination, this exclusion applies in place of the

nuclear hazard exclusion.

Note: This means that the

exception for resulting fire under the nuclear hazard is not

covered when it is the result of war.

2. Secondary

Exclusions

The second

group of exclusions applies to loss or damage caused by or that

results from any of the following loss events. Some of these exclusions

have exceptions, conditions, or limitations that should be noted and

reviewed carefully. The insurance company does not pay for any loss or damage

caused by or that results from any of these events.

a. Acts or Decisions

There is no coverage for loss caused by or that results from any acts or

decisions by any person, organization, or

government entity. This also includes failing to act or decide.

This exclusion has an exception. The act

or decision, or the failure to act or decide, may result in a covered

peril. In that case, the loss or damage that peril causes is covered.

b. Animal Nesting, Infestation, or Discharge

Coverage does not apply to loss or damage when it is due to nesting,

infestation, discharge, or release of waste products or secretions by animals.

The term animal includes birds, insects, and

vermin but is not limited to only these.

This exclusion has an exception. If any of these excluded events results

in a covered peril, the loss or damage that peril causes is covered.

c. Collapse

Loss caused by collapse is excluded.

This exclusion has two exceptions.

- The collapse coverage provided in Other

Coverages- Collapse

- When an excluded collapse results in a

covered peril occurring, coverage applies to the loss or damage that

covered peril caused.

d. Contamination or

Deterioration

Loss or damage that is caused by contamination or deterioration is excluded. This applies to corrosion, decay, fungus, mildew, mold, rot, and rust. It also applies to any quality, fault, or weakness in covered property that causes it to damage or destroy itself. However, this exclusion is not limited to only these described causes. This exclusion has an exception. When contamination or deterioration results in a covered peril, the loss or damage that covered peril causes is covered.

e. Criminal, Fraudulent, Dishonest, or Illegal Acts

Coverage does not apply to loss caused by or that results from criminal, fraudulent, dishonest, or illegal acts, committed by any of the following alone or in collusion with another:

- The named insured

- Others with an interest in the property

- Others to whom the property has been entrusted

- The named insured's partners, officers, directors, trustees, joint venturers, members, or managers, as applicable, based on the named insured’s type of business organization

- Employees of any of the groups listed above. Employees are excluded even if the act occurs when they are not considered to be working.

Coverage applies if employees destroy property. It does not apply if employees steal.

This exclusion does not apply to covered property in the custody of a carrier for hire.

f. Damage, Disturbance, or Erasure of

Recordings

No coverage is provided for loss

that is due to electrical or magnetic damage, disturbance, or any erasure of

electronic recording.

This exclusion has an exception. Coverage applies to loss or damage that lightning causes.

g. Errors and

Omissions

Losses that are caused because of processing, duplicating, or copying errors or omissions are excluded.

This exclusion has an exception. When an error or omission results in a fire or explosion any resulting loss or damage due to that fire or explosion is covered.

|

Example: Arnie needs help and hires Phil and Jill, two of his retired employees, to help him. They work after hours and make timely progress duplicating the records. Scenario 1: One evening, Phil decides to use the automatic feeder when photocopying a fragile document. The document jams in the feeder and is destroyed. This loss is not covered because the loss took place during duplication. Scenario 2: Jill spills coffee on an electrical cord that causes a small fire. The smoke from that fire destroys a different fragile document. This loss is covered. |

h. Fault,

Defect, or Error

Loss or damage that is

due to errors, faults or defects in planning, zoning, surveying, site plans, grading, compacting, land use, or

development is not covered. Loss or damage due to property related design,

blueprint, specification, workmanship, building, maintaining, installing,

renovating, remodeling, or the repairing errors, faults or defects are also

excluded.

An important provision is that this exclusion applies both on and away from the designated premises and applies regardless of negligence.

This exclusion has an exception. One of these events may result in a covered peril. In that case, the loss or damage that peril causes is covered.

i.

Loss of Use

There is no coverage for loss that is

the result of delay, loss of use, or loss of market.

j. Pollutants

There

is no coverage for loss caused by or that results from any release, discharge,

seepage, migration, dispersal, or escape of pollutants. There are two exceptions:

- A specified peril

causes the event

- When a pollutant

release results in a specified peril, the resulting loss from that

specified peril to covered property is covered.

k. Unauthorized Instructions

Coverage does not apply if a loss occurs because property was given to another person or sent to another place based on unauthorized instructions.

l. Voluntary Parting

There is no coverage for loss to covered property

voluntarily given to others, even if the surrender was due to a fraudulent

scheme, trick, or false pretense.

m. Wear and Tear

Loss or damage caused by wear and tear is excluded.

This exclusion has an

exception. Wear and tear may result in a covered peril. In that case, the loss

or damage that peril causes is covered.

n. Weather

This exclusion has an exception. The weather conditions may result in a covered peril. In that case, the loss that peril causes is covered.

What Must Be Done In Case Of Loss

1. Notice

The named insured must give prompt notice of a loss to the insurance company or its agent. The notice must include a description of the property lost or damaged. If a criminal act caused the loss, the appropriate law enforcement agency must also be notified. The insurance company has the right to require that any notice to it be in writing.

2. You Must Protect

Property

During and after a loss, the named insured must take all reasonable steps to protect covered property from further loss. The insurance company pays reasonable costs the named insured incurs to do so if the named insured maintains accurate records to substantiate the costs. Paying these costs is not in addition to the policy limits. There is no coverage for any repairs or emergency measures performed on property not already damaged by a covered peril.

Note: It is important to realize that any such costs incurred will reduce the amount available to pay the actual loss.

3. Proof of Loss

The named insured must complete and return the insurance company's prescribed proof of loss forms within 60 days after the company requests it. The information provided must include the time, place, and circumstances involved with the loss and information on any other insurance coverage that may apply. It must also include the named insured’s interest and the interest of others with respect to the property involved, including liens, and mortgage. Any changes in the title to the property during the policy period must be disclosed, in addition to providing any other reasonable information including inventories, specification and estimates the company may require in settling the loss.

4. Examination

Examination of the named insured under oath may be required in matters that relate to the loss. The insurance company may request these examinations more than once, but such requests must be reasonable. If multiple persons are examined, the company has the right to examine each individual separately.

5. Records

The named insured must produce any records related to the loss. The insurance company must be allowed to make copies and take extracts of them as often as it reasonably requests. Records include tax returns and bank microfilms of all related cancelled checks, but records are not limited to just these.

6. Damaged Property

Both damaged and undamaged property must be made available for the insurance company's inspection as often as reasonably necessary. It must also be allowed to take samples of the property and to inspect it.

7. Volunteer Payments

The named insured has the right to make payments, assume obligations, pay, or offer rewards, or incur other expenses. However, unless the insurance company has given written approval for such actions, the named insured cannot expect any reimbursement. The only exception is that the insurance company will pay for the costs incurred to protect property as item 2. above describes.

8. Abandonment

The insurance company decides when and if it will take ownership of the named insured’s property. The named insured is therefore not permitted to abandon damaged property to the insurance company until the insurance company agrees in writing to accept it.

9. Cooperation

The named insured must cooperate with the insurance company. Any actions required of the named insured within this policy must be performed.

Valuation

1. Actual Cash Value

The value of covered property is subject to provisions that apply to 2. Scheduled Items, 3. Pair or Set, and 4. Loss to Parts below.

The value of all other covered property is its actual cash value at the time of loss. Actual cash is replacement cost new minus depreciation.

2. Scheduled Items

The value of covered property items that is specifically listed on the schedule of coverages is the limit entered for it in the space(s) provided.

3. Pair or Set

The

value of a loss that involves damage or loss of one part of a pair or

set is based on a reasonable proportion of the value of the entire

pair or set. However, the loss of one part of a pair or set is not considered a

total loss.

Note: This recognizes that the value of the whole is greater than

the value of individual parts but that the remaining parts still have value as

separates.

|

Example: Arnie has a

complete set of an architectural encyclopedia that is out of production. He especially schedules the set. One day Arnie

find his office door jimmied open and the office vandalized. Two of the 16

volumes were removed from their scheduled container. The value of the set is

diminished significantly by the loss of the volumes so a payment in excess of

the proportional value is paid. |

4. Loss to Parts

The

value of a lost or damaged part of the property that consists of

several parts is the cost to repair or replace only the lost or damaged part.

How Much We Pay

1. Insurable Interest

The insurance

company does not pay more than the named insured's insurable interest in the

covered property at the time of loss.

2. Deductible

The insurance

company pays only the amount of loss that exceeds the deductible amount on the

schedule of coverages.

3. Loss Settlement

Terms

The insurance company pays the least of the following, subject to items 1., 2., 4., and 5. in this section:

- The amount determined based on the Valuation section

- Costs to repair, replace, or rebuild the damaged property. The material must be of like kind and quality or as similar as practicable.

- The limit

that applies to the damaged property.

|

Example: Arnie’s carrier is able to locate the

missing volumes of Arnie’s encyclopedia and the volumes are in the same, if

not better, condition as the rest of the set. Because the cost to purchase

those volumes is less than the

valuation, the volumes are replaced, and Arnie does not receive a cash

settlement. |

4. Insurance under

More Than One Coverage

Two or more coverages in the coverage form may cover the same loss. In

that case, the insurance company does not pay more than the actual value of the

claim, loss, or damage sustained.

5. Insurance under

More Than One Policy

a. Proportional Share

The named insured may have other coverage subject to the same terms as this coverage form. In that case, this coverage form pays only its share of the covered loss. That share is the proportion that its limit of insurance bears to the limits of insurance on all insurance that covers on the same basis.

b. Excess Amount

There may be other coverage available to pay for the loss other than as described in item 5. a. above. In that case, this coverage form pays on an excess basis. It pays only the amount of covered loss that exceeds the amount due from the other coverage, whether it can be collected or not. Any payment is subject to the limit of insurance that applies.

Loss Payment

1. Loss Payment

Options

a. Our Options

The insurance company has four loss payment options

if a covered loss occurs.

- Pay the value of the

property that sustained loss or damage

- Pay the cost to

repair or replace the property that sustained loss or damage

- Rebuild, repair, or

replace the property with similar property, to the extent possible and it

must be accomplished within a reasonable period of time

- Take any part or all

the property based on the value that has been agreed upon or determined

through an appraisal.

b. Notice of Our Intent

to Rebuild, Repair, or Replace

The insurance company must notify the named insured

of its intent to rebuild, repair, or replace within 30 days of receiving a

properly completed proof of loss.

|

Example:

Arnie’s carrier notified him 15 days after he submitted the properly

completed proof of loss that it was replacing the volumes rather than making

a cash settlement. Arnie has mixed emotions because he had some plans for the

money. |

2. Your Losses

a. Adjustment and Payment of Loss

The insurance company adjusts all losses with and pays the named insured. The only exception is when a loss payee is on the policy.

b. Conditions for Payment of Loss

The insurance company pays a covered loss within 30 days after it receives a properly prepared proof of loss and the amount of loss is established. The amount of loss is determined either through a written agreement between the company and the named insured or after an appraisal award is filed with the company.

3. Property of Others

a. Adjustment and Payment of Loss to Property of Others

The insurance company has the option to adjust and pay losses that involve property of others to either the named insured on the property owner’s behalf or to the property owner.

b. We Do Not Have to Pay You if We Pay the Owner

The insurance company is not obligated to pay the named insured when it pays the property owner. In addition, if the property owner sues the named insured, the company has the option to defend the named insured in that suit.

Other Conditions

1. Appraisal

The insurance company and the insured may not always agree on a covered claim’s value. This condition provides one method to resolve disputed claims.

Either party can request an appraisal to

determine a disputed claim’s value. Once requested, the parties have 20 days to

obtain their own independent and competent appraisers and give their

appraiser's name to the other party. The two appraisers then have 15 days to

select a competent impartial umpire. If they cannot agree on an umpire within

that time period, either can request that a judge in the court of record

in the state where the property is located appoint one.

The appraisers then determine the claim’s

value. They submit any differences to the umpire. Once any two of the three

parties agree, the amount of loss is set.

Each party pays its own appraiser. Both parties

share the umpire’s cost and other expenses equally.

2. Benefit to Others

The insurance

provided does not directly or indirectly benefit any party that has custody of

the named insured's property.

3. Conformity with

Statute

Any condition

in this coverage form that conflicts with any applicable law is amended to

conform to that law.

4. Estates

a. Your Death

This

applies only when the named insured is an individual. When a named insured

dies, the person who has custody of the named insured's property is an insured

for that property until a qualified legal representative is appointed. Once the

named insured’s legal representative is named, that person has

custody but only for the property covered under this policy.

b. Policy Period is not Extended

This

coverage does not extend past the policy’s expiration date.

5. Liberalization

A revision of this coverage form or an applicable endorsement that takes effect during the policy period or within six months of when this coverage takes effect may broaden coverage without an additional premium charge. In that case, the broadened coverage applies to this coverage.

6. Misrepresentation,

Concealment, or Fraud

This coverage

is void if any insured at any time willfully concealed or misrepresented a

material fact that relates to the insurance provided, the property covered, or

its interest in the property. It is also void if any insured engaged in fraud

or false swearing with respect to the insurance provided or the property

covered.

Note: The named insured must deal with the insurance company honestly. Its rights of recovery may be voided if it intentionally misrepresents or conceals a material fact or information. This means that the insurance is treated as simply having never existed versus a particular claim being denied.

7. Policy Period

Only covered

losses that occur during the policy period are paid.

8. Recoveries

Payment of the loss does not end the obligations of the named insured and the insurance company toward one another. Additional provisions apply if the insurance company pays a loss and the lost or damaged property is subsequently recovered or the parties responsible for the loss pay for it.

Either party that recovers property or payment must inform the other. Recovery expenses that either party incurs are reimbursed first. If the named insured keeps the recovered property, it must refund the amount of the claim the insurance company paid, unless the company agrees to a different amount. If the claim paid is less than the agreed loss due to applying a deductible or other limitation, any recovery is prorated between the named insured and the insurance company, based on the company's respective interest in the loss.

9. Restoration of

Limits

Payment of a

claim does not reduce the limit available for future claims.

10. Subrogation

The insurance company acquires the named insured's rights of recovery from third parties after it pays a loss. The named insured must help the company secure those rights. The insurance company is not obligated to pay the loss if the named insured hinders or impairs its rights of subrogation.

The named

insured has the right to agree in writing to waive recovery rights from any

party when it does so before a loss occurs.

11. Suit against Us

The insurance company cannot be sued by anyone for any coverage until all the terms of the coverage form have been met. Suits must be brought within two years after the insured first knew about a loss. If a state law invalidates this condition, any suit brought must comply with that law’s provisions and begin within the shortest period of time allowed by law.

Note: It is normal for a basic coverage form to be modified by mandatory state-specific endorsements that address issues that relate to that state.

12. Territorial

Limits

Covered property must be in the United States of America, its territories, and possessions, Canada, or Puerto Rico for coverage to apply.

ENDORSEMENTS

AAIS has developed two endorsements to use with Valuable Papers and Records Coverage.

IM 1561–Exclusions for Library Coverage

This endorsement restricts coverage for library risks. Property in the Custody of a Borrower is added to Property Not Covered. Exclusions are added that limit coverage for certain damages a borrower or user of library services might cause such as vandalism, not returning books, and books mysteriously disappearing.

IM 1275–Calendar Date or Time Failure Exclusion

This endorsement excludes losses due to any electronic data processing equipment, computer program, software, media, or data failing to correctly recognize, interpret, or process any encoded, abbreviated, or encrypted date or time.

UNDERWRITING CONSIDERATIONS

Other than determining the location to be insured, the limits to be provided and the types of storage containers used, the most critical issue in underwriting this coverage is to actually identify them. The named insured must be made aware of the types of papers and records that can and should be covered. The only way full recovery can be made for a unique document or record is to list it and provide a value for it. If the papers or records can be duplicated, duplicates should be made and kept elsewhere.

Menu (click here to expand or to collapse)

Menu (click here to expand or to collapse)